How to Track NFT Wash Trading

With the seamless integration of APIs, the dark corners of NFT wash trading are illuminated, revealing hidden networks and suspicious transactions. Stay one step ahead of fraudulent schemes, safeguarding the authenticity and value of NFTs with unwavering precision.

Other indicators could include unusual price movements, constant bid-ask spreads, or a dearth of market depth.

What is NFT wash trading?

NFT traders engage in such activity to fabricate a deceptive notion of heightened demand and artificially inflate the value of an NFT collection. Keep an eye out for telltale signs of NFT trades, such as a conspicuous gap between the floor price and list price of a collection’s NFTs.

NFT wash trading entails the market manipulation of trading volumes and liquidity to create a false impression of high market activity. Wash trading can be used to earn token rewards. Some NFT marketplaces offer token rewards to users who trade frequently. By wash trading, a trader can artificially inflate their trading volume and earn more token rewards.

The fate of the NFT in question rests solely on the owner’s discretion – it’s either a sale or no sale. Engaging in wash trading NFTs is simply buying and selling the exact same token, with the volume comparison being less significant than the token’s selling price.

Retrieving NFT metadata from the blockchain is tedious and time-consuming. NFT API does the heavy lifting for you across NFTs platforms, making the data you need searchable and accessible.

Using Bitquery to Track Wash Trading

The Bitquery NFT API is an immensely powerful tool that grants access to blockchain data, encompassing transactional and on-chain data, for a multitude of blockchain networks, including Ethereum, Binance Smart Chain, and beyond.

Unveiling Profit Motives: Identifying Circular Trade Between Buyer and Seller

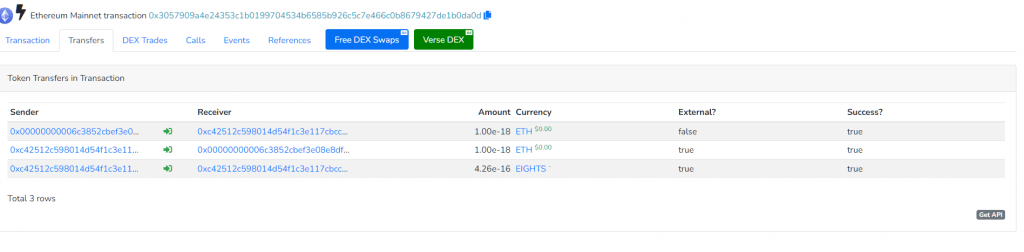

Since a single entity is trying to profit, look for transactions where the buyer and seller are separated by a single transfer to the Seaport Contract Address. In the screenshot below, the sender buys the Eights NFT on Opensea and sells it for a higher price.

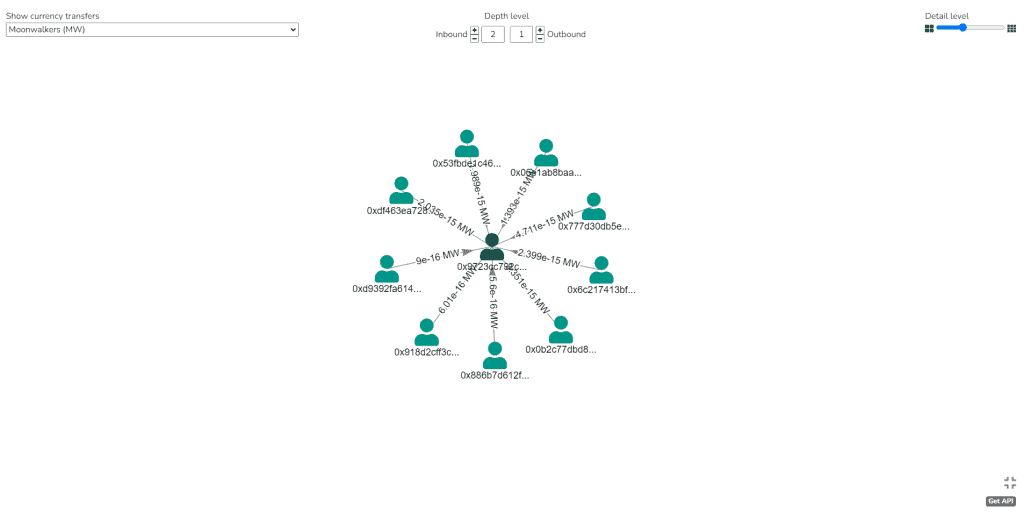

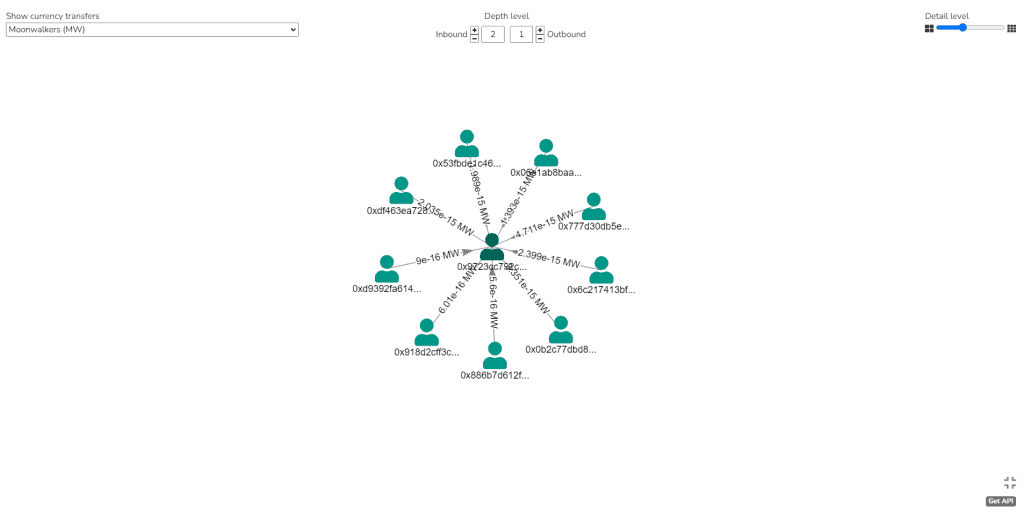

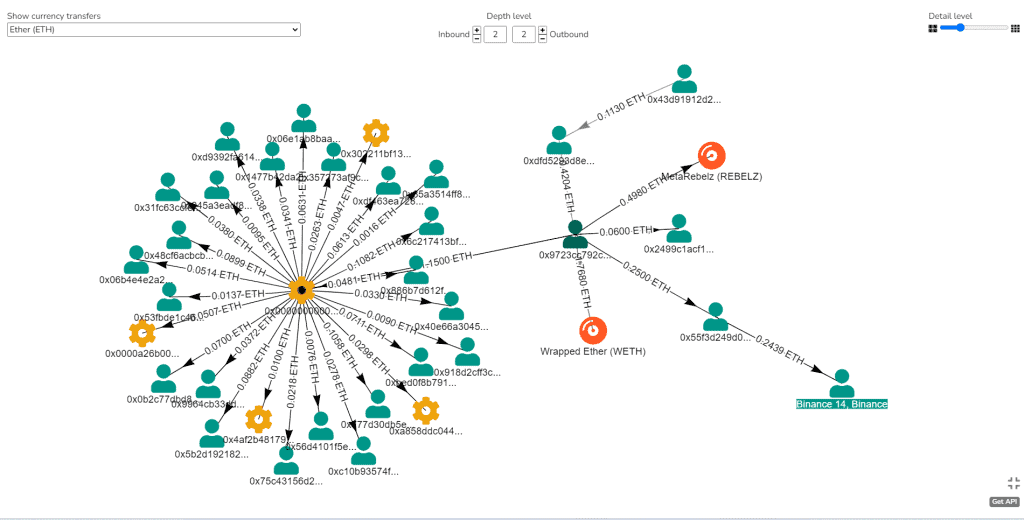

Tracing Fund Consolidation: Monitoring Multiple Addresses’ Funds Flow to a Single Address

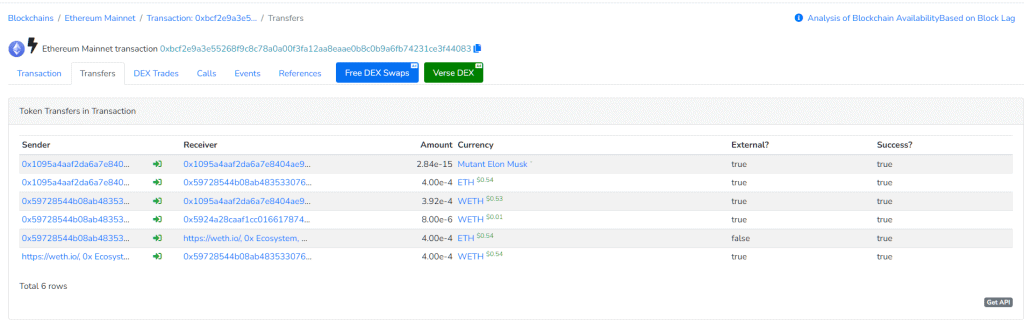

The image above shows a tracing of fund consolidation where multiple addresses’ funds are flowing to a single address. Most flagged transaction patterns involve a few addresses, suggesting manual trading rather than automated systems or bots. These transactions are flagged as potentially suspicious, indicating a possible involvement in market manipulation.

Track inbound and outbound NFT transfers

Wash trading involves the receiver address being manipulated to create false trading volume or price movements.

For example, to check if this address “0x1095a4aaf2da6a7e8404ae9572fc20bbbfb23905” is involved in wash trading, investigate inbound and outbound transfers where the specified address is the sender/receiver.

Pay attention to any suspicious or irregular patterns, such as frequent transfers between the wash trading wallet and other addresses, repetitive transactions involving the same NFTs, or high volumes of transfers within short timeframes.

Cross-reference the identified transactions with other relevant data, such as trading volume, price movements, and market activity, to assess if there are indications of wash trading. Look for abnormal spikes or patterns in trading volume or price that may suggest manipulation.

Mass Acquisition: Exploring Bulk Purchases of Identical NFTs

One key indicator of potential wash trading is the mass acquisition of identical NFTs.

By continuously purchasing identical NFTs at inflated prices, wash traders can create the illusion of value appreciation. You can start with the analysis of top holders of a particular NFT, say Moonwalkers. These top holders represent individuals or entities with a significant stake in the collection. By closely examining their transactions and holdings, we can uncover potential wash trading activities.

To learn how to export blockchain data in a csv, see this tutorial: https://youtu.be/gKlRZdbApTs

Closing Notes

As experts expect the tactics and strategies of the wash traders to evolve over time, it may be necessary to update the procedures spelled out in this article in the coming months to make them future-proof. Explore this topic in greater detail by visiting the data dashboard used for this evaluation, Ethereum NFTs Wash Trading.

The wash-trading filter is a highly dynamic feature that relentlessly evolves to offer the most precise outlook of market activity and eradicate any unnecessary interference.

In closing, the Bitquery API emerges as a game-changing force in the realm of detecting NFT wash trading. Its exceptional capabilities empower individuals to unravel the hidden layers of transaction data, exposing intricate patterns and suspicious trading behaviours. By harnessing the formidable power of the Bitquery API, we can pave the way for a robust and transparent NFT ecosystem. Let us seize this invaluable tool and forge a future where integrity prevails, fostering trust, credibility, and true value in the world of NFTs.

This post was co-authored by Divyasshree and guest author Hamid Akhtar.

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.