Uniswap API - Top 10 Uniswap Trading Data APIs

The decentralized crypto exchange Uniswap has a Total Value Locked (TVL) of $2.79 billion. Serving as an open-source protocol, it’s pivotal for providing liquidity and enabling the trading of ERC20 tokens on the Ethereum blockchain.

With the introduction of its latest Uniswap v3, the platform offers enhanced features such as concentrated liquidity and various fee tiers, making it a powerhouse in the Decentralized Exchange (DEX) Trading.

In today’s data-driven era, accessing accurate and timely information from platforms like Uniswap is crucial. For traders, developers, and crypto enthusiasts, a plethora of APIs and tools have emerged, offering insights ranging from uniswap staking, the nuances of uniswap v2 and v3, to the broader spheres of Automated Market Maker (AMM) data.

In this guide, we’ll walk our readers through around ten of these essential APIs and tools, ensuring you have the resources to navigate the decentralized data landscape seamlessly.

1. Bitquery

Bitquery provides a comprehensive range of data products that facilitate cross-chain analytics, DEX trading insights, and DeFi APIs. Through Bitquery’s robust infrastructure, users can access both historical and real-time blockchain data via diverse interfaces, including GraphQL APIs.

Here are some popular APIs offered by Bitquery:

- Trading Pairs API: For users interested in viewing all trades of a token, this API provides details on all its trading pairs. Protocols like Uniswap utilize pairs or pools.

- DEX Trades API: This API delivers trading-related data from various DEXs such as Uniswap, Pancakeswap, 0x, and more. It includes both historical and real-time trades as well as pricing information for tokens. Users can employ various filters to explore smart contract call details from numerous perspectives, including by DEX, protocol, token, trade, pool, and more.

- Transactions API: This offers comprehensive data on transactions, covering aspects like call count, gas, hash, type, sender address, and recipient address.

- Smart Contract Calls API: Users can access detailed information regarding smart contract calls, such as arguments, callers, raw data, and support for Opcodes. This API also permits filtering to delve into smart contract call details from varied dimensions.

- Address Trades API: This fetches the latest buy-side and sell-side trades from the DEXTrades dataset on the Ethereum network for a specified buyer or seller.

- Events API : It provides users with real-time access to blockchain event data, which includes changes such as transactions, token transfers, and contract creations.

If users have any queries, they can send text the team on their Telegram channel. The team is consistently active there.

For those who prefer not to interact with APIs but still wish to access intriguing Uniswap data, we recommend the Bitquery Explorer. Here, users can view a range of information including the latest trades, traded currencies over time, trades by time, token pairs, volume, and more.

Additionally, Bitquery offers an IDE, ensuring that users can instantly visualize the results of their queries.

For those unfamiliar with coding or using GraphQL, Bitquery provides an “Explore Queries” feature where users can find numerous queries crafted by their expert team.

If users are still left with lingering questions, we suggest referring to the guide on Simple REST APIs to get Uniswap data (DEX Data APIs).

Moreover, a trove of community tutorials is also available at your disposal for readers keen on delving deeper, we highly recommend Uniswap APIs: Get Pools Data, Tokens, and Create Charts.

2. The Graph Protocol

The Graph is a decentralized protocol designed for indexing and querying blockchain data. It facilitates the querying of data that might otherwise be challenging to access directly. A subgraph pulls data from a blockchain, processes it, and stores it so that it can be seamlessly queried using GraphQL.

The Uniswap subgraph chronologically indexes data from the Uniswap contracts. It organizes information regarding pairs, tokens, the entirety of Uniswap, and more. This subgraph updates whenever a transaction occurs on Uniswap. It operates on The Graph protocol’s hosted service and is open for queries.

Subgraph Explorer is a sandbox for querying data and offering endpoints for developers. Uniswap V2 Subgraph is an example of source code for the deployed subgraph. The subgraph not only offers a snapshot of Uniswap’s current state but also archives historical data. It powers uniswap.info but isn’t intended as a data source for structuring transactions.

Substreams is another robust blockchain indexing technology, specifically crafted for The Graph Network. Substreams empower developers to create Rust modules, curating data streams in collaboration with the community. By emphasizing parallelization, it achieves exceptionally high-performance indexing in a streaming-first approach.

3. Covalent

The Covalent Unified API offers the ability to extract token balances, positions, and detailed historical transaction data from various blockchain networks. This data supports a wide range of end-user applications, including wallets, investor dashboards, taxation tools, and other yet-to-be-identified use cases.

They provide a range of three primary products to cater to various digital transaction needs. First is the Token Balances API, a unified system that enables users to access a wallet’s ERC20 balances, allowances, transfers, and prices seamlessly. The second product they offer is the Transactions API, which is a scalable solution designed to fetch historical transactions spanning across more than 100 chains. Lastly, they have the NFT API, which stands out as a comprehensive platform that grants immediate access to NFT media, metadata, and easily interpretable sale transactions on over 100 chains.

4. Moralis

The Moralis DeFi API, integrated with a broad spectrum of Decentralized Exchanges (DEXs) spanning various EVM blockchains. This API provides immediate access to liquidity reserves and pair data across these blockchains enhancing their ability to develop and expand their dapps. Key features of the DeFi API include ,fetching liquidity reserves for specified pair addresses in AMMs based on Uniswap and retrieving the pair address linked to specific token addresses from Uniswap-based AMMs.

Moralis offers a comprehensive suite tailored to the needs of Web3 developers and the broader crypto community. Their NFT API allows for cross-chain NFT transfers and provides easy access to NFT prices and metadata. With the Token API, users can access up-to-the-minute data on token prices, transfers, and ownership.

5. Dune Analytics

Dune is a web-based platform designed for querying public blockchain data and aggregating it into visually appealing dashboards. It offers robust tools to analyze cross-chain data across various tokens, wallets, and protocols, and users can seamlessly share their insights with the community. The Dune API not only enhances your data integration workflow but also significantly boosts your efficiency.

Key features include executing queries, which allows users to turn an existing query into an endpoint or fetch the latest results, and editing queries through a comprehensive CRUD (Create, Retrieve, Update, Delete/Archive) API. While the executing queries feature is available to Community users, the editing queries feature is exclusive to Premium users.

6. Token Terminal

Token Terminal is a platform that consolidates financial data from leading blockchains and decentralized applications. The Token Terminal API provides access to all the data that drives the Token Terminal web application. Users subscribed to the Token Terminal API plan can retrieve this data using their designated API key, available on their account page. It’s essential to keep the API key confidential; refrain from sharing it or storing it in publicly accessible locations such as GitHub or client-side code. The API is read-only, supports REST calls, employs intuitive resource-oriented URLs, and returns JSON-encoded responses and error messages.

7. Parsiq

Parisq has indexed tens of millions of blocks across multiple platforms, including Ethereum, BNB Smart Chain, Avalanche, Polygon PoS, Polygon zkEVM, Arbitrum, opBNB, and Metis Andromeda. They’ve captured hundreds of millions of transactions, calls, and events right from block zero up to the present moment. All this data is instantly accessible to users, irrespective of the intricacy of their inquiries.

Furthermore, with the Balances API, users can access real-time balances and delve into transaction histories, offering the advantage of retrieving and displaying user balances across a multitude of wallets and protocols.

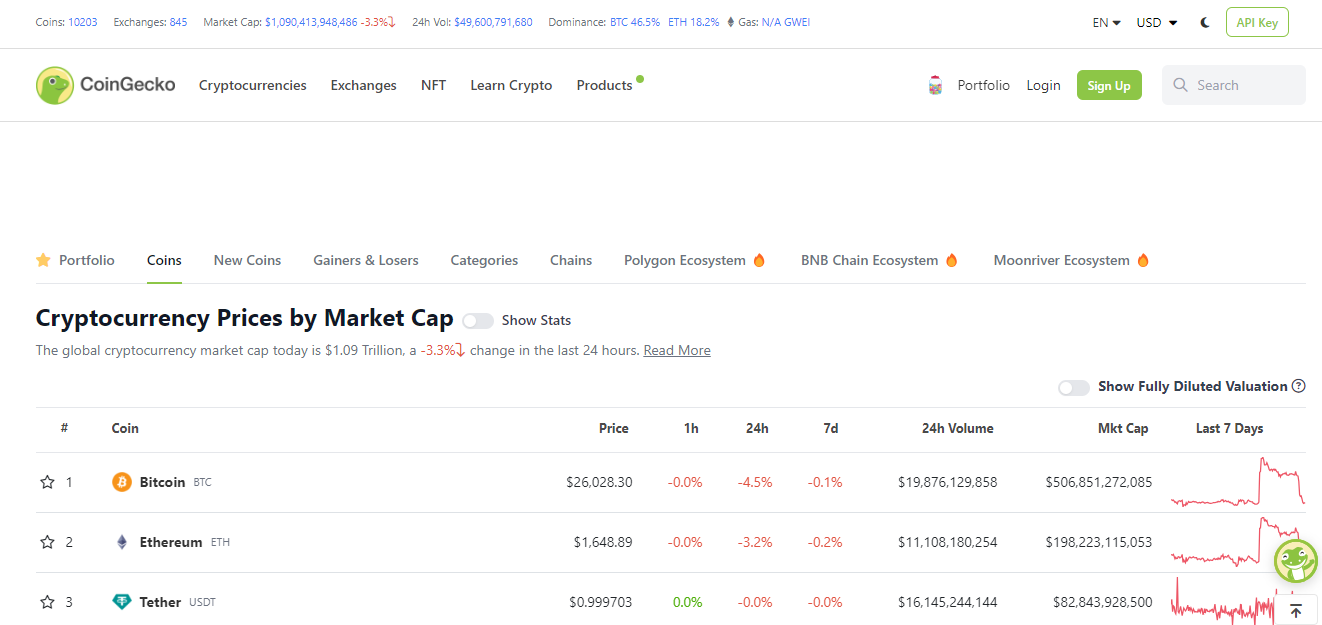

8. CoinGecko

CoinGecko, the world’s largest independent crypto data aggregator, is integrated with over 700 crypto exchanges and lists more than 10,000 coins. It offers the most comprehensive and reliable crypto data via RESTful JSON endpoints. Numerous projects, Web3 developers, researchers, institutions, and enterprises rely on CoinGecko’s API to access price feeds, market data, metadata, and historical data for crypto assets, NFTs, and exchanges.

9. 0x

0x provides the essential building blocks for crafting powerful Web3 applications. As the Web3 ecosystem expands with a growing number of platforms, DEX protocols, and tokens, development becomes more challenging. However, their APIs and solutions simplify this landscape and decrease the associated infrastructure overhead.

They offer a comprehensive suite of APIs designed to expedite the development, launch, and scaling of their financial products across eight EVM-compatible chains. The 0x API suite is the optimal solution for enhancing trade speeds, ensuring competitive prices, and delivering an outstanding user experience in their application. To begin, users will need to establish an account to access the 0x Dashboard. This will allow them to generate API keys for new projects, oversee and manage integrations, and tap into a wealth of developer resources and new APIs.

10. Blockvision

BlockVision is a leading multi-chain node, mempool, FT, NFT, and DeFi API provider, offering real-time data retrieval for developers. Their platform includes AceNode, which lets users query real-time archived data and monitor on-chain pending transactions. Their NFT APIs empower users to instantly find, verify, display, and rank any NFT, while their FT APIs provide swift querying and indexing of all token-related data. Furthermore, the DeFi APIs make it simple to query the asset activity of addresses within DeFi protocols.

How to Choose the Best Uniswap Data Provider?

Navigating the vast landscape of Uniswap data providers can be daunting. With the rise of decentralized finance and the plethora of APIs available, it’s crucial to select a provider that aligns with your specific needs. When selecting a Uniswap data provider, consider the following factors:

- Variety of APIs: Providers like Bitquery offer a diverse range of APIs, from trading pairs to DEX trades. Ensure the provider covers all facets of Uniswap, including staking, v2, v3, and other relevant DEX data.

- Track Record: Consider providers with a reputation for accuracy, such as The Graph Protocol, which indexes data chronologically from Uniswap contracts.

- Ease of Use: Platforms like Bitquery offer features like “Explore Queries” for those unfamiliar with coding, making data extraction more accessible.

- Visualization Tools: Providers like Bitquery and Dune Analytics offer visualization dashboards, ensuring that users can instantly see the results of their queries.

- Active Support: Bitquery, for instance, has an active Telegram channel where the team responds typically within an hour.

- Educational Resources: Platforms like Bitquery offer guides, community tutorials, and other resources to help users understand and utilize the data effectively.

- Free vs. Paid: While some providers might offer free tiers or community access, others might charge for premium features. Bitquery offers a free developer plan. Priced at $0, this plan provides 100,000 points every month. Users under this plan can make up to 10 API calls per minute.

- Integration Capabilities: Platforms like Bitquery support multiple EVM blockchains, enhancing the ability to develop and expand dapps.

By considering these factors and referencing the specific features and strengths of the mentioned platforms, users can select a Uniswap data provider that best suits with their requirements.

Conclusion

In the rapidly evolving world of DeFi and Uniswap, having reliable data sources is paramount. Uniswap has revolutionized the crypto landscape, and with the plethora of APIs and tools available, accessing its vast reservoir of data has never been easier. Whether you’re a trader, developer, or crypto enthusiast, these tools can provide invaluable insights into the ever-evolving world of decentralized exchanges. By choosing the right data provider and leveraging the power of these APIs, you can stay ahead of the curve in the dynamic world of crypto.

FAQs

- What is the difference between Uniswap v2 and v3?

- Uniswap v3 introduces features like concentrated liquidity and multiple fee tiers, offering more flexibility and potential returns for liquidity providers compared to v2.

- How does uniswap staking work?

- Uniswap staking involves locking up a certain amount of tokens in a liquidity pool to earn rewards. In return for staking their tokens, users receive a proportion of the trading fees generated by the platform.

- Why is Decentralized Exchange (DEX) data important?

- DEX data provides insights into trading volumes, liquidity, token prices, and more. This information is crucial for traders and investors to make informed decisions in the decentralized finance (DeFi) space.

Post written by guest author Yash

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.