UTXO vs. Account-Based Blockchains: A Comparative Analysis

Imagine a marketplace where everyone trades using gemstones. Each gemstone represents a certain amount of value, just like digital coins in a blockchain network.

Now, in one part of the marketplace, there's a group of traders using the UTXO (Unspent Transaction Output) system. These traders carry around a sack full of gemstones, each labeled with the amount they're worth. Whenever they want to buy something, they simply reach into their sack and pick out gemstones whose total value equals or exceeds the cost of what they're buying. Transactions are created by consuming existing UTXOs and producing new ones in their place. This is like how UTXO-based blockchains work.

On the other side of the marketplace, there's another group of traders using the Account-Based system. Instead of carrying around a sack of gemstones, each trader has an account where their gemstone balance is recorded. When they want to buy something, they simply tell the marketplace how much they want to spend, and the marketplace updates their account balance accordingly. It's like having a bank account where you can transfer money back and forth. This is similar to how account-based blockchains, like Ethereum, keep track of balances.

So, basically in UTXO-based blockchains for example Bitcoin, the ledger keeps track of individual transaction outputs. Every transaction consumes one or more UTXOs and creates one or more new UTXOs as outputs.

Each UTXO can only be spent once, and the sum of the values of the inputs of a transaction must equal or exceed the sum of the values of the outputs. UTXOs are not directly associated with accounts; rather, they represent unspent funds that are available for spending. This model offers some advantages like increased privacy and scalability, as well as easier parallelization of transaction validation.

Whereas, in account-based blockchains for example Ethereum, the ledger keeps track of account balances. Each account has a balance associated with it, and transactions involve transferring value between accounts. Instead of UTXOs, account-based blockchains maintain a state of account balances. Transactions involve updating the state of account balances according to the rules of the blockchain protocol.

Both approaches have their own set of trade-offs and are suitable for different use cases. UTXO-based blockchains are often preferred for systems where scalability and privacy is critical.

while account-based blockchains may be favored for applications that require

- more complex smart contract capabilities

- flexibility in managing the state.

Comparison between UTXO and Account Based Networks

By understanding the strengths and capabilities of each type of network, developers and businesses can choose the most suitable architecture for their specific use case, driving innovation and adoption in the blockchain ecosystem. Both UTXO and Account-Based systems have their own strengths and are suited for different situations.

Transaction Structure

UTXO-Based Transaction Structure:

In UTXO-based blockchain networks, transactions consist of inputs and outputs. Each input refers to a specific unspent transaction output (UTXO) from a previous transaction. These inputs are then consumed or spent in the current transaction. The outputs represent new UTXOs that are created as a result of the transaction, specifying the amount of cryptocurrency being transferred and the recipient's address.

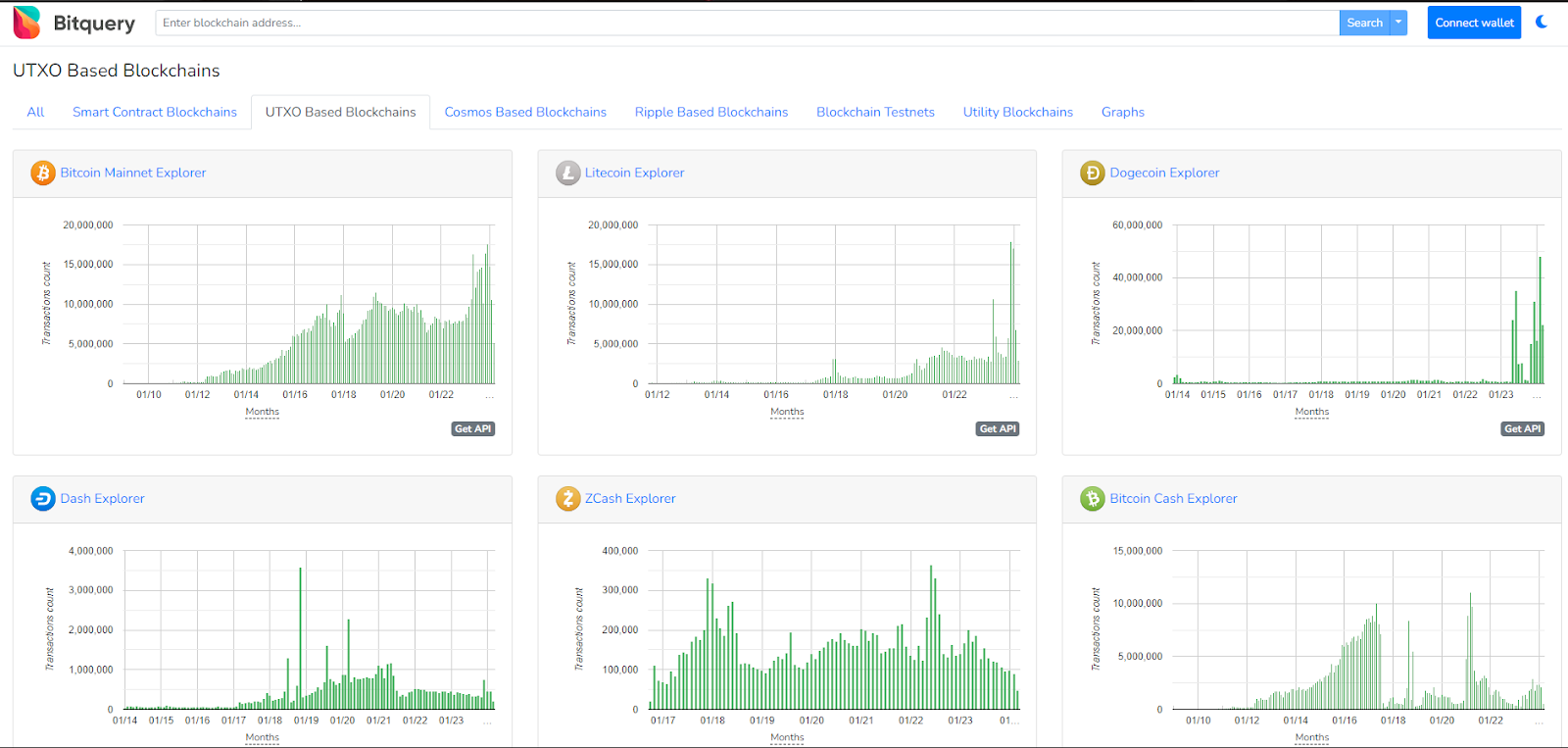

Importantly, each UTXO can only be spent once, and the sum of the inputs must equal or exceed the sum of the outputs, ensuring that transactions are valid. Other UTXO-based blockchain networks can be accessed here

Fig: UTXO-based blockchain networks on Bitquery platform

More resources regarding various UTXO-based networks can be accessed here.

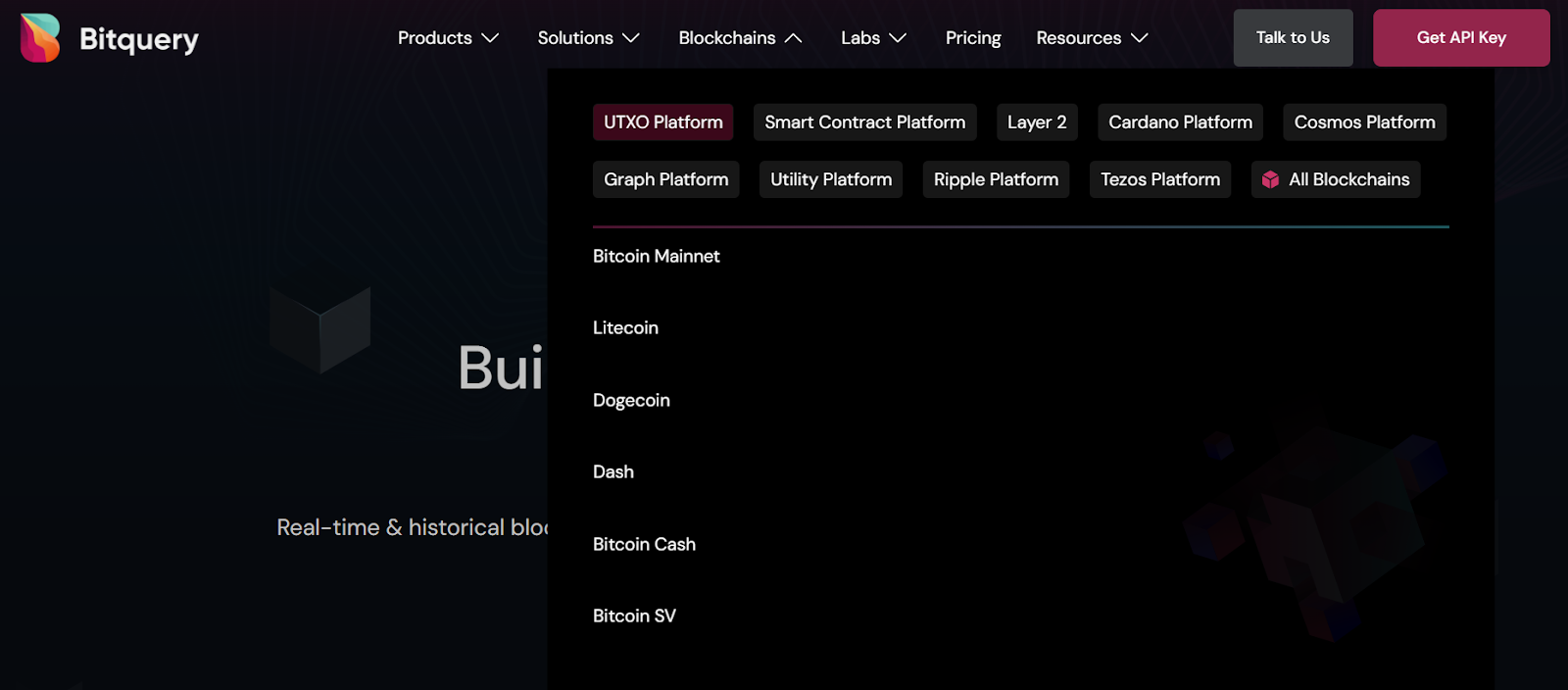

Fig: Bitquery Platform with UTXO-based network options

Account-Based Transaction Structure:

In contrast, account-based blockchain networks track account balances directly. Transactions in these networks involve debiting and crediting account balances. When a user initiates a transaction, they specify the recipient's address, the amount of cryptocurrency to transfer, and any additional data required by the transaction.

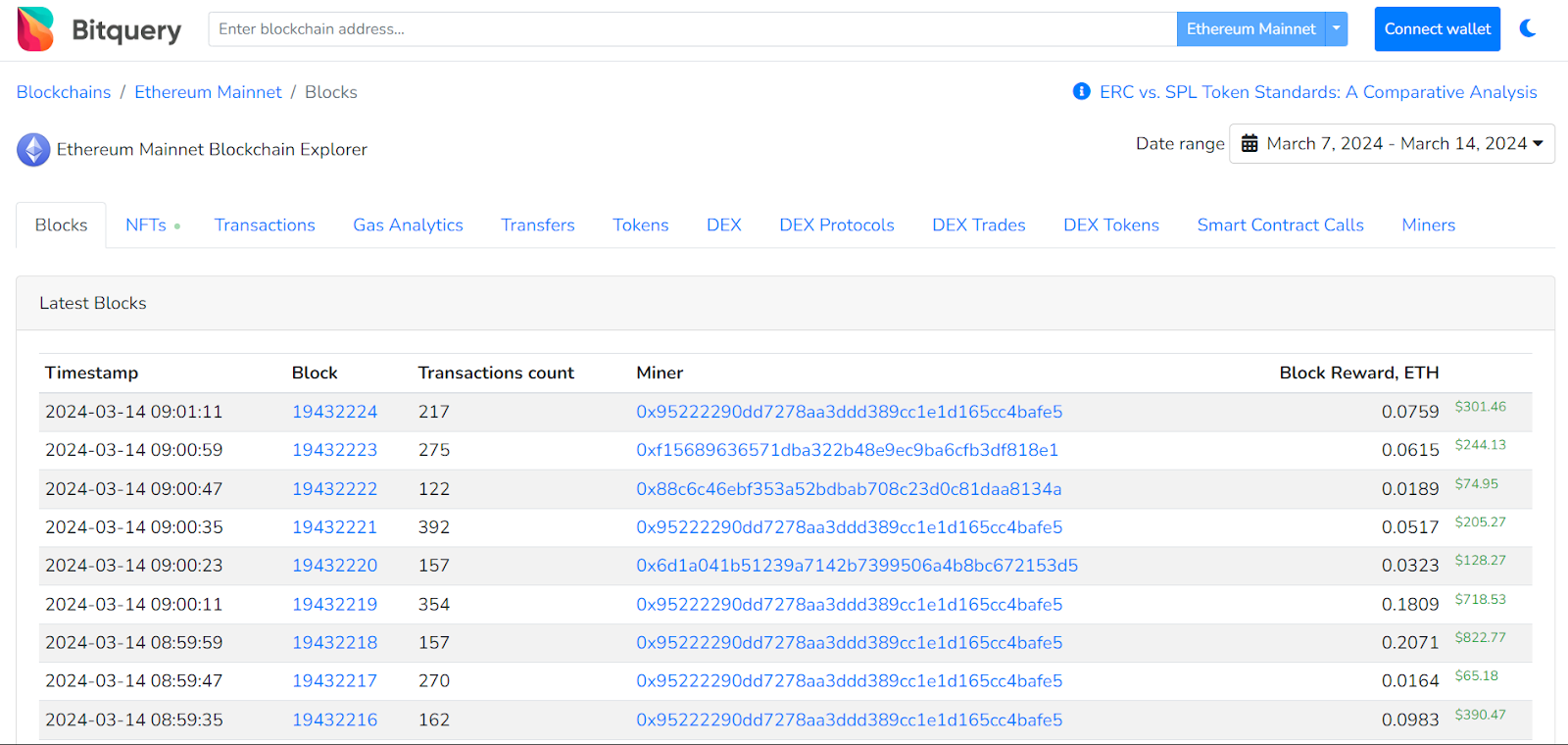

The sender's account balance is debited by the specified amount, while the recipient's account balance is credited accordingly. Unlike UTXO-based transactions, there are no explicit inputs and outputs; instead, the transaction updates the account balances directly. One of the examples Ethereum can be accessed here.

Fig: Account-based blockchain network, Ethereum on Bitquery platform

Data Representation

UTXO-Based Data Representation:

In UTXO-based blockchain networks, data is represented primarily by unspent transaction outputs (UTXOs). Each UTXO consists of two main components: an amount of cryptocurrency and a locking script that specifies conditions for spending the UTXO.

These UTXOs form the basis of the blockchain's transaction history and are used as inputs in subsequent transactions. By tracking the history of UTXOs, users can determine the ownership and transaction history of each unit of cryptocurrency.

This can be briefly understood by running this query.

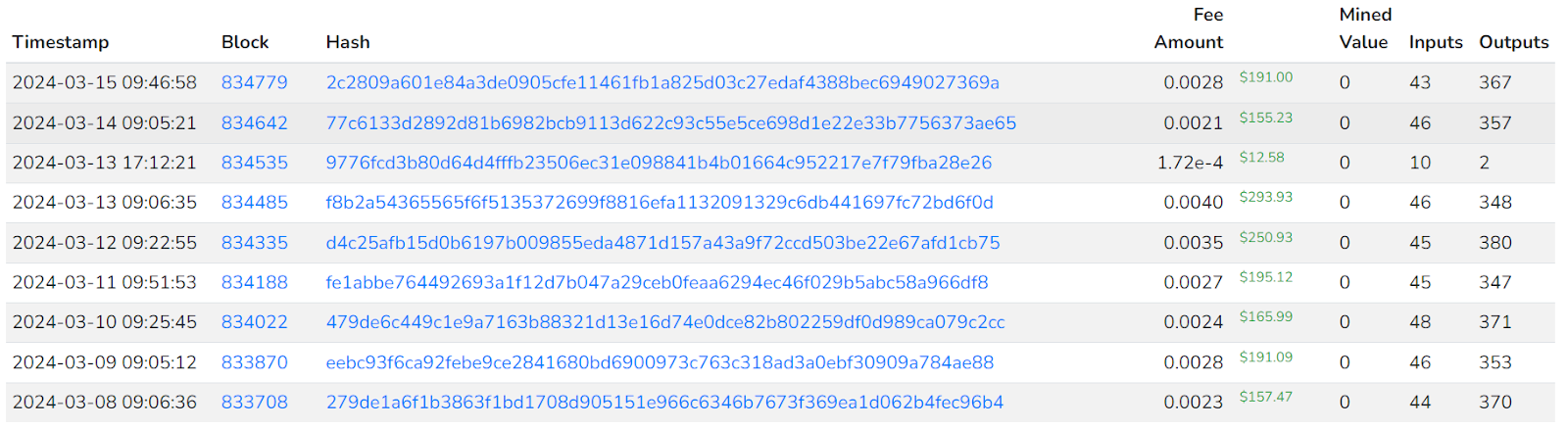

Fig: Data represented for Bitcoin Address over Bitquery Platform

Fig: Data represented for Bitcoin Address over Bitquery Platform

The information that we get from this is:

- Transactions: Each transaction entry contains details about a specific Bitcoin transaction.

- Block: Indicates the block in which the transaction was recorded. It includes the timestamp of the block and its height (block number).

- Hash: Unique identifier for each transaction, generated using cryptographic hashing algorithms.

- Fee Value: Represents the transaction fee paid by the sender to incentivize miners to include the transaction in a block.

- Mined Value: Indicates the total value of bitcoins mined in the block containing this transaction. In these transactions, the mined value is zero, suggesting that no new bitcoins were generated as block rewards.

- Input Count: Specifies the number of inputs (sources of funds) involved in the transaction.

- Output Count: Specifies the number of outputs (destinations of funds) generated by the transaction.

- Fee Value USD: Indicates the estimated value of the transaction fee in US dollars, based on the prevailing exchange rate at the time of the transaction.

Account-Based Data Representation:

In contrast, account-based blockchain networks represent data primarily through account balances. Each user account on the network has an associated balance, which represents the amount of cryptocurrency owned by that account. Transactions in these networks involve updating account balances directly, with debits and credits reflecting transfers of cryptocurrency between accounts.

Additionally, account-based networks maintain a state trie or Merkle tree structure to efficiently store and retrieve account information, including balances and transaction history. This data structure enables quick access to account information and facilitates efficient transaction processing.

This can be understood by running this query.

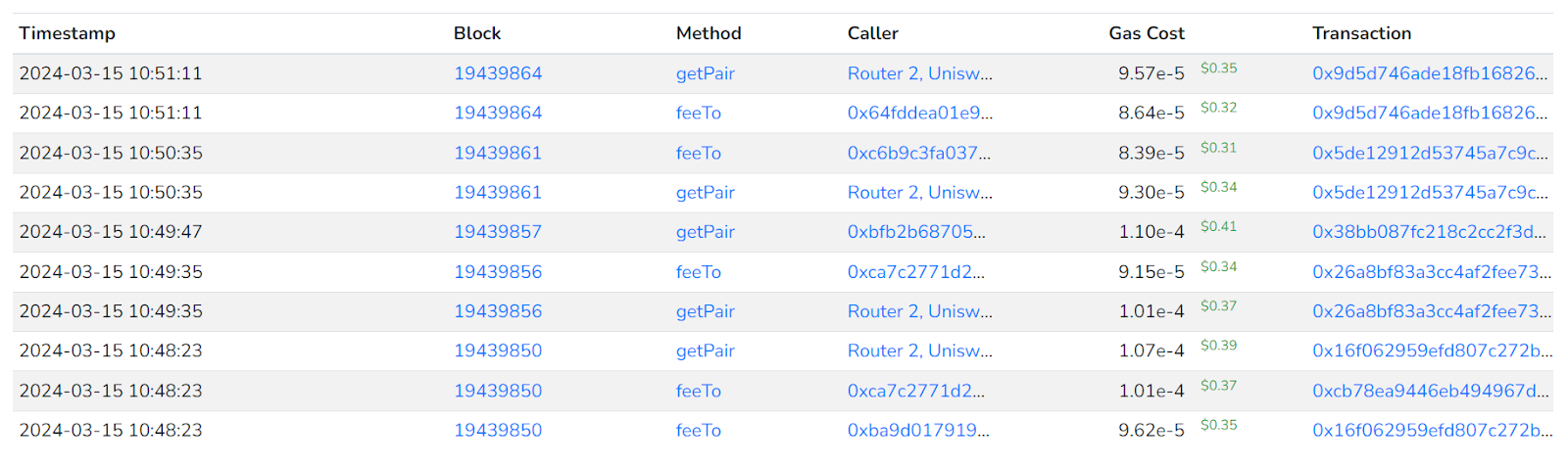

Fig: Data represented for Ethereum Address over Bitquery Platform

-

Smart Contract Calls: Each entry contains details about a specific smart contract call.

-

Block: Indicates the block in which the smart contract call was executed. It includes the timestamp of the block and its height (block number).

-

Smart Contract Method: Specifies the name of the method called in the smart contract and its signature hash.

-

Address: Indicates the address of the smart contract involved in the call. It may include an annotation to provide additional context about the contract's purpose.

-

Transaction: Specifies the hash of the transaction that triggered the smart contract call.

-

Gas Value: Represents the amount of gas consumed by the smart contract call. Gas is a unit used to measure the computational work required to execute operations on the Ethereum network.

-

Gas Value USD: Indicates the estimated value of the gas consumed in US dollars, based on the prevailing gas price at the time of the call.

-

External: Indicates whether the smart contract call is external (initiated by an Ethereum account) or internal (triggered by another smart contract).

Privacy and Traceability

UTXO-Based Privacy and Traceability:

In UTXO-based blockchain networks privacy is enhanced due to the independent nature of each unspent transaction output (UTXO). Since UTXOs are not directly linked to user accounts, it becomes challenging to trace the flow of funds across the network.

This makes it more difficult for observers to identify the parties involved in a transaction and track their transaction history. However, while UTXOs provide a level of privacy, the transparency of the blockchain still allows for some degree of traceability through sophisticated analysis techniques.

This can be better understood with the help of a query.

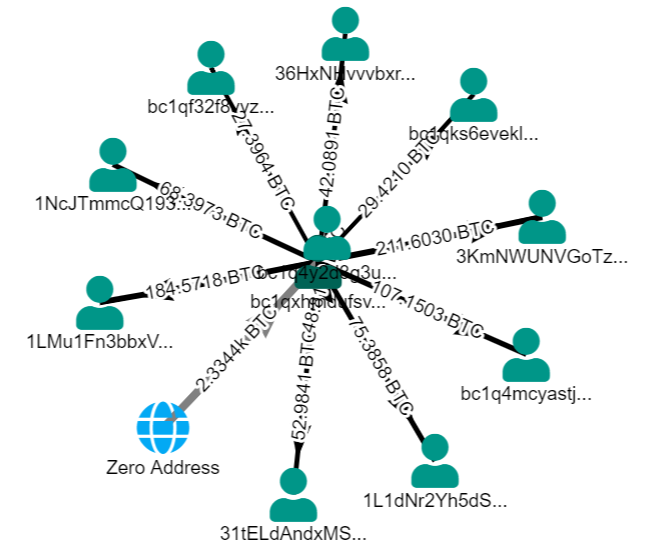

The provided JSON data represents the movement of Bitcoin between different addresses, categorized into inbound and outbound transactions.

- Inbound Transactions (Money Received):

These transactions represent instances where Bitcoin is received into a particular address. This can be likened to money flowing into a wallet or account. In the provided data, inbound transactions include Receiving certain Bitcoins from an unknown sender into the receiver address and receiving a small amount of Bitcoin from a specific sender address into the same receiver address.

- Outbound Transactions (Money Sent):

These transactions represent instances where Bitcoin is sent from a particular address to another address. This can be likened to money flowing out of a wallet or account. In the provided data, outbound transactions include sending Bitcoin from the sender address to the receiver address and sending varying amounts of Bitcoin from the same sender address to different receiver addresses.

Fig: Moneyflow represented in Bitcoin Address over Bitquery Platform

Fig: Moneyflow represented in Bitcoin Address over Bitquery Platform

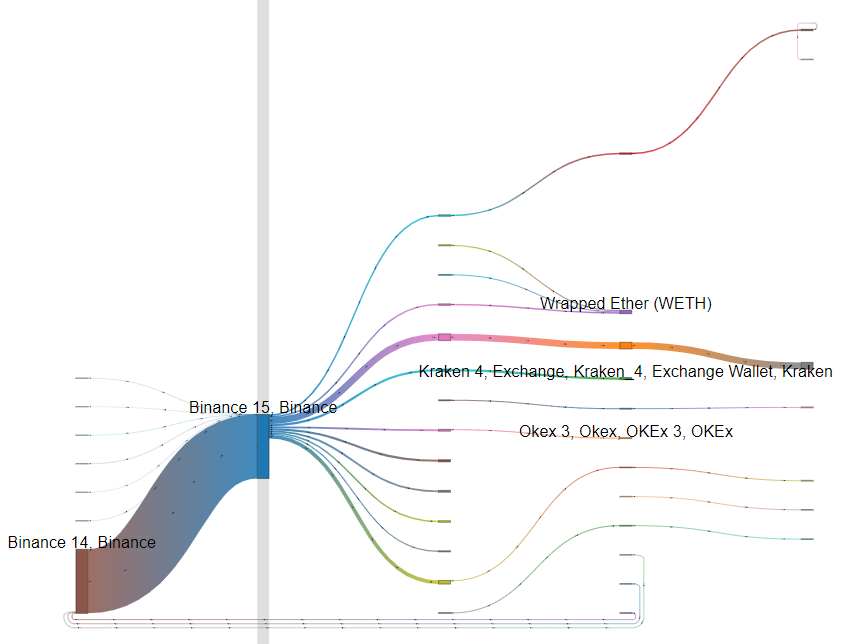

Account-Based Privacy and Traceability:

In account-based blockchain networks transaction history and account balances are publicly accessible, offering less privacy compared to UTXO-based networks. Each account's balance and transaction history are visible on the blockchain, allowing observers to trace the flow of funds between accounts.

This can be better understood with the help of a query.

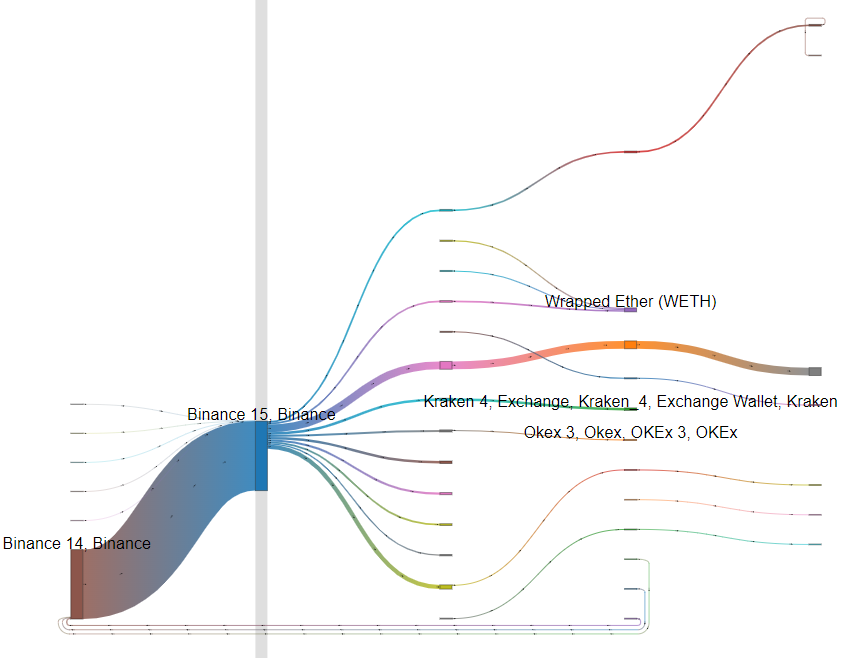

This data represents transactions on the Ethereum blockchain involving inbound and outbound flows of Ether (ETH), the native cryptocurrency of the Ethereum network. Each transaction involves a sender and a receiver, along with the amount of ETH transferred. In terms of money flow, here's a breakdown of the transactions:

- Inbound Transactions:

These transactions involve the movement of ETH into the specified Ethereum addresses.

The total inbound ETH received by the receiver address is calculated by summing up the amounts from each inbound transaction. These transactions often represent deposits or transfers of ETH from external sources into Ethereum addresses, such as exchanges or wallets. From the below given moneyflow diagram, the inbound is with Binance 14.

- Outbound Transactions:

These transactions involve the movement of ETH out of the specified Ethereum addresses.

The total outbound ETH sent by the sender address is calculated by summing up the amounts from each outbound transaction. These transactions often represent withdrawals or transfers of ETH from Ethereum addresses to external sources, such as exchanges, wallets, or other Ethereum addresses. From the below-given moneyflow diagram, the outbound is with Kraken 4 and others.

Fig: Moneyflow represented in Ethereum Address over Bitquery Platform

Scalability

UTXO-Based Scalability:

UTXO-based blockchain networks potentially offer scalability advantages due to their ability to process transactions in parallel. Since each unspent transaction output (UTXO) represents a separate unit of currency and transactions consume and create UTXOs independently, the validation of transactions can be parallelized.

This parallel processing capability allows UTXO-based networks to handle a large number of transactions concurrently, potentially leading to higher throughput and improved scalability.

Account-Based Scalability:

Account-based blockchain networks may face scalability challenges, especially as the number of accounts and transactions on the network grows. Since transactions involve updating account balances directly, the processing of transactions may become bottlenecked as the network becomes more congested.

Additionally, account-based networks typically maintain a global state of account balances, which can become increasingly unwieldy to manage as the network scales.

-

Smart Contract Capabilities

UTXO-Based Smart Contract Capabilities:

UTXO-based blockchain networks typically have limited or more complex smart contract capabilities compared to account-based networks. While Bitcoin's scripting language allows for basic smart contract functionality, it has certain limitations and is not as expressive as the programming languages used in account-based networks.

Smart contracts on UTXO-based networks often involve constructing complex transaction scripts to implement desired functionalities, which can be more challenging for developers.

Account-Based Smart Contract Capabilities:

Account-based blockchain networks offer robust smart contract capabilities, allowing developers to create and deploy complex decentralized applications (DApps). Ethereum's Turing-complete scripting language enables the creation of highly expressive and flexible smart contracts, which can execute arbitrary code and interact with other smart contracts and external systems.

Smart contracts on account-based networks enable a wide range of use cases, including decentralized finance (DeFi), tokenization, gaming, and supply chain management, among others.

Ease of Use

UTXO-Based Ease of Use:

UTXO-based blockchain networks may be less intuitive for users and developers accustomed to traditional banking systems. Managing UTXOs can require a deeper understanding of the underlying mechanics of the blockchain, including concepts like transaction inputs and outputs, change addresses, and transaction fees.

As a result, interacting with UTXO-based networks may involve a steeper learning curve for users and developers, particularly those unfamiliar with the intricacies of blockchain technology.

Account-Based Ease of Use:

Account-based blockchain networks offer a more familiar model for users and developers, resembling typical financial operations. Transactions involve updating account balances directly, without the need to manage individual transaction outputs (UTXOs). This simplifies the user experience and makes it easier for users to understand and interact with the blockchain.

Additionally, account-based networks typically provide more developer-friendly tools and resources for building decentralized applications (DApps), further enhancing ease of use for developers.

State Management

UTXO-Based State Management:

UTXO-based blockchain networks primarily focus on managing the state of individual transaction outputs (UTXOs). Each UTXO represents a specific amount of cryptocurrency that has not been spent and is available for future transactions.

The state of the network is determined by the set of unspent UTXOs, which are collectively maintained and updated by the network's participants. Managing the state of UTXOs involves tracking their ownership, verifying transactions, and ensuring that double-spending does not occur.

This can be understood with the help of a query.

Sample response

"outbound": [

{

"sender": {

"address": "bc1qxhmdufsvnuaaaer4ynz88fspdsxq2h9e9cetdj",

"annotation": null

},

"receiver": {

"address": "3KmNWUNVGoTzHN8Cyc1kVhR1TSeS6mK9ab",

"annotation": null

},

"amount": 213.82217731999867,

"depth": 1,

"count": 8

},]

The information conveyed through this query is that the data represents transactions involving Bitcoin, categorized into inbound and outbound transactions. Each transaction includes information about the sender's address, the receiver's address, the amount of Bitcoin transferred, transaction depth, and count.

- Inbound Transactions (Money Received):

The inbound transaction involves receiving certain Bitcoin into the receiver address. The sender's address is not specified. The second inbound transaction involves receiving a small amount of Bitcoin from the sender address into the same receiver address. As seen from the moneyflow diagram below, the inbound transaction is recorded with Binance 14 address.

- Outbound Transactions (Money Sent):

The outbound transactions involve sending various amounts of Bitcoin from the sender address to different receiver addresses. Each outbound transaction specifies the amount of Bitcoin sent and the respective receiver address. As seen from the moneyflow diagram below, the outbound transaction is recorded with Kraken 4 and various others.

Overall, the data provides a detailed view of the movement of Bitcoin funds, with inbound transactions representing money received into specific addresses and outbound transactions representing money sent from specific addresses to other addresses. This information can be useful for tracking financial activities and analyzing the flow of funds within the Bitcoin network.

Fig: Transaction represented in Bitcoin Address using Bitquery Explorer

Account-Based State Management:

In contrast, account-based blockchain networks manage the state of user accounts directly. Each user account on the network has an associated balance, which represents the amount of cryptocurrency owned by that account. Transactions involve updating account balances directly, with debits and credits reflecting transfers of cryptocurrency between accounts.

Additionally, account-based networks typically maintain a global state of account balances, which includes information such as account balances, contract code, and storage data. This global state is stored and updated by network nodes, ensuring consistency and integrity across the network.

Use Cases

UTXO-Based Networks

-

Peer-to-Peer Transactions: They are well-suited for peer-to-peer transactions, allowing users to send and receive digital currency without the need for intermediaries.

-

Privacy-Centric Transactions: They provide enhanced privacy features, making them suitable for use cases where privacy is a primary concern. Cryptocurrencies like Monero and Zcash leverage UTXO-based architectures to implement advanced privacy techniques.

-

Scalable Microtransactions: The UTXO model enables efficient parallel validation of transactions, making UTXO-based networks suitable for handling large volumes of microtransactions at scale.

Account-Based Networks

-

Decentralized Finance (DeFi): They have become the foundation for the burgeoning DeFi ecosystem, enabling a wide range of financial applications such as decentralized exchanges (DEXs), lending platforms, and automated market makers (AMMs).

-

Tokenization and Asset Management: They facilitate the creation and management of digital assets and tokens, making them ideal for use cases such as tokenization of real-world assets, tokenized securities, and non-fungible tokens (NFTs).

-

Decentralized Applications (DApps): They provide a robust platform for building decentralized applications (DApps) with programmable features and logic.

In conclusion, the comparison between UTXO-based and account-based blockchain networks highlights the distinct characteristics and use cases of each architecture. By understanding the strengths and capabilities of both types of networks, developers and businesses can make informed decisions when choosing the most suitable architecture for their specific use case.

UTXO-based networks offer advantages in terms of enhanced privacy, scalability potential, and efficient handling of microtransactions. On the other hand, account-based networks provide robust smart contract capabilities. They offer a more familiar model for users and developers, resembling traditional banking operations and providing ease of use.

Blog written by Nikita M

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.